Helping you understand how much risk you are prepared to accept when making an investment decision.

The following process is designed to help you understand how much risk you are prepared to accept when making an investment decision. It is not trying to place you, as a person, in a particular risk category, but rather guide you on the amount of risk you might want to take if you are looking at a specific investment decision. It also aims to help you understand how an investment matched to this level of risk might behave.

The process will bring you through five stages:

1. RISK

2. A FEW QUESTIONS

3. VALIDATION

4. INVESTMENT SUITABILITY

5. REPORT

1. Risk

There are a number of different types of risk you need to consider before making an investment. Here are just a few to think about.

2. A few questions

We are now going to ask you 5 simple questions so we can understand a bit more about your investment experience and attitude to risk. The questions will ask you about:

- Your investment experience

- The importance of this investment to you

- Your attitude to the safety of this investment

- The risk and return expectations

- Your attitude to short term loss

3. Validation

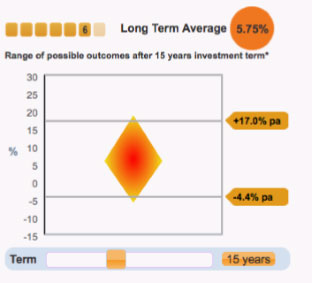

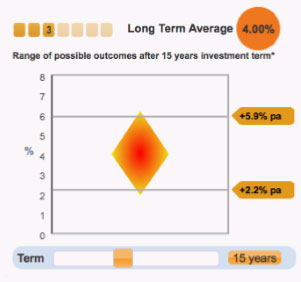

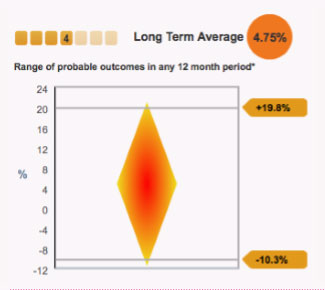

Based on your answers to the questions posed in Step 2, your Financial Advisor will suggest a level of risk he or she thinks is most appropriate for your needs.

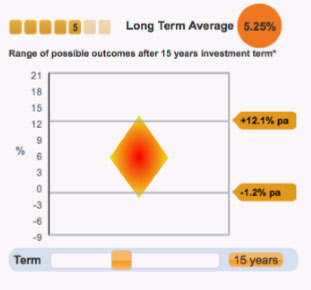

Although an investment’s risk can change over time, this tool can give you a feel for the types of return an investment may demonstrate if its risk level stays the same. Your advisor will bring you through possible ranges of returns for the level of risk they think most appropriate. You can then decide if this matches what you had in mind, or you can look at alternative risk options.

4. Investment Suitability

There are a number of different types of risk you need to consider before making an investment. Here are just a few to think about.

5. Recommendation

Your appetite for risk is one of the inputs into which investment is suitable for your current needs. Your Financial Broker or Adviser will conduct a full Financial Fact Find with you before recommending a specific fund or funds. The output from this Investment Suitability Process should be read in conjunction with your Financial Broker or Adviser’s recommendation.

It is important to be aware that there are a number of different ways to look at assessing appetite for risk and it is not an exact science.

This process does not take into account all your personal circumstances and therefore the calculations may not be appropriate to your personal circumstances.

You should not rely solely on this process to make an investment decision. In all cases we recommend that you consult a Financial Broker or Advisor who will conduct a full financial review and fact-find with you and advise you accordingly.

The calculations provided by the Friends First Investment Suitability Process are for general illustration purposes only, based on the limited inputs you have given and assumptions made. Although Friends First endeavours to ensure that this ‘Investment Suitability Process’ is accurate, we cannot guarantee it is free of errors or suitable for any user’s intended purposes. To the extent permitted by law, under no circumstances will Friends First be liable for any investment loss or damage caused by a user’s reliance on information obtained by using this process.

Latest News

Brokers Ireland Newsletter – 27 August 2021

The benefits of using a financial adviser. Brokers Ireland recently published the latest research showing how much better off financially and mentally consumers are for using a financial adviser such as OBI. Remarkably, the [...]

Choose a fund to beat the odds

The range of funds on the market can be baffling to new investors. Here’s what you need to know. Savers moving from deposits into funds face a bewildering array of options in the ever [...]

I want to invest to put my children through college

Ivan Kennedy (49) from Limerick set up a couple of investment funds a few years ago in order to pay for third-level fees and costs for his two young children, Michelle and Richard. “Whether [...]